who pays sales tax when selling a car privately in michigan

Notice of New Sales Tax Requirements for Out-of-State Sellers. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under.

Do You Pay Sales Tax On A Mobile Home Purchase Mhvillager Blog

No matter the sticker price of a car its important to remember.

. According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come with substantial taxes. You can avoid paying sales tax on a used car by meeting the exemption circumstances which include. Although not legally required in Michigan a Bill of Sale should include the following information.

A recent study by the Tax Policy Institute found that the average citizen who pays a 50 sales tax is about 770. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. If you are buying or selling a car for the first time you may be unaware of how taxes are paid for this type of transaction.

Buying a car may be done through a car dealer or from a private seller. These fees are separate from the sales tax and will likely be collected by the Michigan Department of Motor Vehicles and not the Michigan Department of Treasury. You will register the vehicle in a state with no sales tax because you live or have a business there.

Streamlined Sales and Use Tax Project. What transactions are generally subject to sales tax in Michigan. For example lets say that you want to purchase a new car for 30000 you would use the following formula to calculate the sales tax.

And permits valid 60 days cost 20 of the annual registration fee or 40 whichever is more. But if the original sales price plus the improvements add up to 8000 and you sell the car for. Selling a Junk Car in Michigan.

Legal full name address drivers license number and signature. Either way tack on an additional 10 service charge. After all a title transfer comes with fees and paperwork and car ownership comes with its own regular costseven if the vehicle is a gift.

Selling your car directly to a junkyard is an option available to you as well. Title transfers must take place within 30 days from the date of sale otherwise a late penalty fee will be charged. When the excitement winds down you and your giftee will need to sit down and determine the logistical details of the car.

On any car purchase in Michigan you will need to pay a 6 sales tax. Ad Get a Custom CarMax Appraisal Offer So That Youre the One In Control. You can calculate the sales tax in Michigan by multiplying the final purchase price by 06.

Average DMV fees in Michigan on a new-car. It depends on the length of the permit. Michigan requires a 6 use tax be paid by the seller on all private vehicle sales unless you are transferring the title to someone with a tax exempt status.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Year Make and Model of the Vehicle. That depends on the sate and the laws regarding sales tax.

Create on Any Device. Sell or Trade In Your Vehicle. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The buyer will pay sales tax on the purchase price of the vehicle regardless of sales tax paid by a previous buyer of the vehicle even if the seller is. Ad High-Quality Reliable Form For Selling A Car Privately Developed by Lawyers.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. To calculate how much sales tax youll. If this seems high the good news is there is no other sales tax applied to car purchases at the county city or any other level.

Who pays sales tax when selling a car privately in Illinois. Buying a car or any other motor vehicle is a taxable transaction. Thats why the fact that the sales tax will go on the federal governments website next month is the most important thing happening in Washington right now.

30000 x06 1800. For vehicles worth less than 15000 the tax is based on the age of the vehicle. We Will Buy Your Vehicle Even If You Dont Buy Ours.

You plan to move to a state without sales tax within 90 days. If a vehicle is purchased privately the sales tax must be paid at a branch. If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid State Form 48842.

Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts. Vehicle Identification Number VIN Date of Sale. Answer 1 of 9.

Several examples of exceptions to this tax are vehicles which are sold specifically. In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing in other states there is no sales tax on a private car sale used but if you buy from a dealer you. But permits valid 30 days cost 10 of the annual registration fee or 20 whichever is higher.

If I Buy A Car In Another State Where Do I Pay Sales Tax

Illinois Car Sales Tax Countryside Autobarn Volkswagen

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Michigan Laws About Private Used Car Sales

Michigan Laws About Private Used Car Sales

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

What Paperwork Do I Need To Sell My Car Privately Privateauto

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Michigan Title Transfer Etags Vehicle Registration Title Services Driven By Technology

Car Tax By State Usa Manual Car Sales Tax Calculator

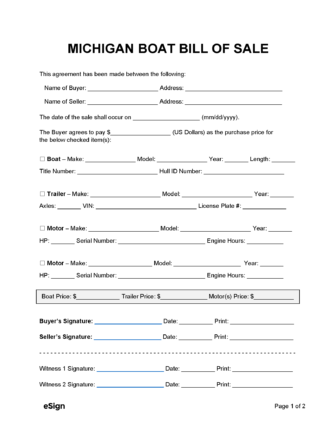

Free Michigan Boat Bill Of Sale Form Pdf Word

![]()

Michigan Vehicle Registration And Title Information Vincheck Info

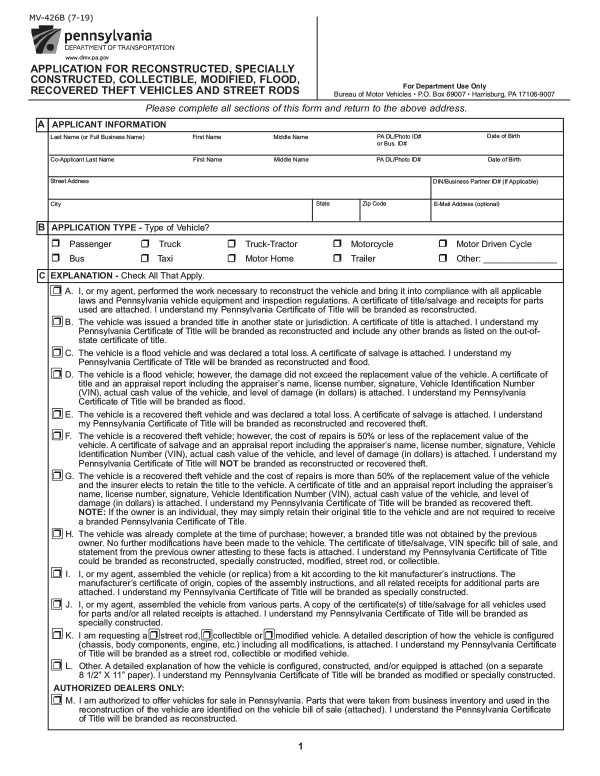

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Nj Car Sales Tax Everything You Need To Know

Bill Of Sale Form Michigan Motor Vehicle Bill Of Sale Templates Fillable Printable Samples For Pdf Word Pdffiller

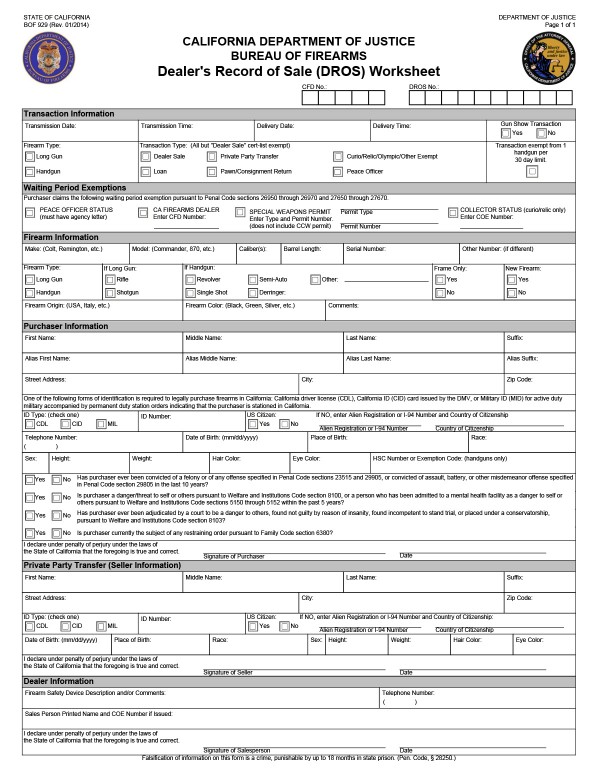

All About Bills Of Sale In California The Facts And Forms You Need

What S The Car Sales Tax In Each State Find The Best Car Price