north dakota sales tax registration

North Dakota sales tax. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of.

Printable North Dakota Sales Tax Exemption Certificates

A sales tax permit can be obtained by registering online with the North Dakota Taxpayer Access Point TAP or by mailing in the Sales and Use Tax Permit Application Form.

. To avoid any potential issues with the state further down the line it is essential that you check whether you are required to register for a sales tax. Register to get a North Dakota sales tax permit. That means the effective rate.

After reading the guidelines complete the. 800 524-1620 North Dakota State Sales Tax Online. New Business Registration North.

Up to 25 cash back The North Dakota Securities Department however must preapprove this exemption. Streamlined Sales Tax Registration System SSTRS The Streamlined Member states created the Streamlined Sales Tax Registration System SSTRS to provide you a simple and free system. Register for a North Dakota Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form.

The topics addressed within this site will assist you. If you are an LLC corporation partnership or S-corporation you also need to register with the North Dakota Secretary of State. Form 306 - Income Tax Withholding Return.

NORTH DAKOTA SALES TAX 5 County Tax - Yes Personal Property Tax No 701 328-7088 or 877 328-7088 REGISTRATIONS Documented Boats are Not Required to Be Registered. North Dakota Sales-Tax-Registration File for North Dakota Business Licenses and North Dakota Permits at an affordable price. Where to Register for a North Dakota Sales Tax Permit.

Registrations are valid from January 1 2020 to December 31 2022 fees are prorated according to the date of registration. This permit will furnish your business with a unique sales tax number. Simplify the sales tax registration process with help from Avalara.

If you currently have or plan to have employees performing services within North Dakota you should read the Income Tax Withholding Guideline. Apply online at the North Dakota Taxpayer Access Point TAP. The state sales tax rate for most purchases of tangible personal property in North Dakota is 5 and local governments can impose their own taxes as well.

Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied. Ad Fill out one form choose your states let Avalara take care of sales tax registration. Ad Fill out one form choose your states let Avalara take care of sales tax registration.

5 of the sale price. To get preapproved the corporation must file a Limited Offeree Exemption. Thank you for selecting the State of North Dakota as the home for your new business.

How do you register for a sales tax permit in North Dakota. North Dakota Sales Tax Permit. Registered users will be able to file and.

Dont waste your time run. The New Business Registration site assists businesses starting or relocating to North Dakota with planning financing registration and licensing issues. Sales Tax Registration Simple Online Application.

This state uses the North Dakota Office of State Tax Commissioners Application to Register for Income Tax Withholding and Sales and Use. North Dakota Sales Tax Application Registration. Simplify the sales tax registration process with help from Avalara.

Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021. Any business that sells goods or taxable services within the state of North Dakota to customers located in North Dakota is required to. Wednesday January 19 2022 - 1100 am.

How are car trade-ins taxed in North. Welcome To The New Business Registration Web Site. North Dakota Licenses and Permits.

Or file by mail using the North Dakota Application. The state of North Dakota became a full member of Streamlined Sales Tax on October 1 2005. There are two ways to register for a sales tax permit in North Dakota either by paper application or via the online.

Determine what products or services you will be selling and if. Ad Sales Tax Registration Wholesale License Reseller Permit Businesses Registration. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner. The information on this site is general information and.

How To Register For A Sales Tax Permit In North Dakota Taxjar

Sales Tax Guide For Online Courses

North Dakota Sales Tax Small Business Guide Truic

Income Tax Update Special Session 2021

How To Register For A Sales Tax Permit Taxjar

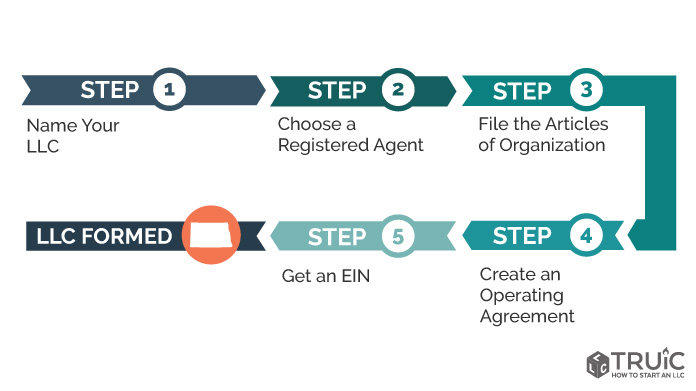

North Dakota Llc How To Start An Llc In North Dakota Truic

Sales Tax By State Is Saas Taxable Taxjar

North Dakota S Corp Start An S Corp In Nd Truic

Sales Use Tax South Dakota Department Of Revenue

How To Register For A Sales Tax Permit In North Dakota Taxjar

How To Register For A Sales Tax Permit Taxjar

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com

North Dakota Tax Refund Fill Online Printable Fillable Blank Pdffiller

North Dakota Secretary Of State Nd Sos Business Search Secretary Of State Corporation Search

Learn All About And Download The South Dakota State Seal Incl Its History